Hi!

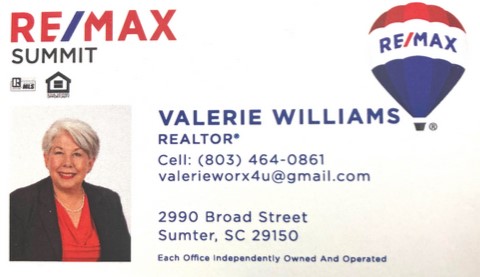

I am Valerie Williams, a realtor with the #1 Real Estate Agency in Sumter, SC (including Shaw AFB and surrounding areas) - Using RE/MAX's advanced technology and my customer service, determination and work ethic, I can help you buy or sell your home and get the best value for your money.

Call, text or email me!